Big Cypress Capital (BCC), an SB360 affiliate, is an investment manager that allocates capital through unique thematic private equity, credit, and real estate strategic relationships.

Big Cypress Capital is led by industry veterans with decades of investment experience that has been tested through several economic cycles and includes deep immersion in private equity, credit, and real estate investment management.

BCC’s investment strategy is more nuanced than a typical private equity investment allocation – it centers on service-driven long-term strategic relationships. BCC cultivates partnerships with emerging alternative asset managers and real estate operators (“Strategic Partners”) with proven and robust thematic investment pipelines. These Strategic Partners leverage deep domain expertise to identify investment opportunities within high-growth sectors and geographies.

BCC’s executives, investment professionals, and advisors provide Strategic Partners with valuable organizational support and mentoring services, engendering a deep level of loyalty and trust between the parties. This support and counsel results in long-term value creation within each Strategic Partner’s platform. Strategic Partners favor BCC’s programmatic discretionary equity commitments given its proven successful track record of delivering high-impact support services, enabling emerging managers and real estate operators to rapidly build institutional caliber investment programs.

Strategic Partners and Institutional Capital Relationships

Generating Outsized Risk-Adjusted Returns

BCC’s highly differentiated thematic investment strategies leverage valuable and deeply entrenched Strategic Partner relationships that generate outsized risk-adjusted investment returns through thoughtfully tailored investment structures. Strategic Partners execute the investment strategies with BCC’s assistance, support, mentorship, and fiduciary oversight.

Access

Access to Strategic Partners that institutional investors may overlook due to platform size, tenure, or other criteria.

Expertise

Time-intensive, highly tailored mentoring, advice and support services are continuously provided to each Strategic Partner.

Coordination

Capital is carefully and strategically coordinated, leveraging each Strategic Partner’s existing relationships and BCC’s extensive and rapidly expanding capital partner network.

Risk Management & Fiduciary Oversight

Closely coordinated through a combination of in-house asset management capabilities and in-sourced industry experts/specialists.

A Growth Focused Real Estate Investment Strategy

BCC targets markets with strong population and employment growth. Target markets are in states experiencing notable multiyear in-migration trends, leading to some of the nation’s strongest commercial real estate income growth.

Representative Real Estate Investments

BCC leverages its innovative thematic real estate investment platforms to identify joint venture opportunities and institutional LP equity investment commitments.

704 at The Quarter

Charlotte, NC

The Quarter

Charlotte, NC

Avenues at Atherton

Charlotte, NC

CubeSmart

Philadelphia, PA

Extra Space Storage

Charlotte, NC

Switch Yard

Charlotte, NC

CubeSmart

District Heights, MD

Extra Space Storage

Baltimore, MD

CubeSmart

Tampa, FL

Thrift Road

Charlotte, NC

Extra Space Storage

Savannah, GA

Extra Space Storage

Durham, NC

BCC Team

BCC’s leadership team has established a track record of identifying thematic investment opportunities generating outsized risk-adjusted returns across multiple economic cycles and investment structures.

Max Mazzone

CEO and Co-CIO

Big Cypress Capital

Kevin Dooley

CFO and Co-CIO

Big Cypress Capital

Jonathan Searls

Vice President

Big Cypress Capital

Big Cypress Capital

4850 Tamiami Trail North

Suite 301

Naples, Florida 34103

239.280.8691

When experience matters, so does the source.

Though we’ve never strayed from our original mission, transactions that span the globe have added depth of experience to SB360’s reputation as one of the more creative private merchant banking groups in existence today. Short and long term equity investments. Financial assistance. Commercial Real Estate investments. Asset recovery. Auctions. Liquidations. Event sales. New store opening projects. We’ve grown since our founding, and our client services are more comprehensive than ever before.

It’s easy to understand why so many companies rely on SB360. We’ve helped hundreds of businesses manage change, restructure assets, turn around dwindling profitability, and convert underperforming assets into newfound liquidity – and we’ve done it more effectively than anyone else.

Avenues at Atherton

Charlotte, NC

The Avenues at Atherton is a 31,000 square foot adaptive retail property originally built in 1957 and situated on 1.37 acres in Charlotte’s South End. This joint venture project was originally acquired in 2018 and was renovated in 2019 to restore the property to peak marketability.

The joint venture successfully exited the property in July 2022, selling the project to an alternative investment manager.

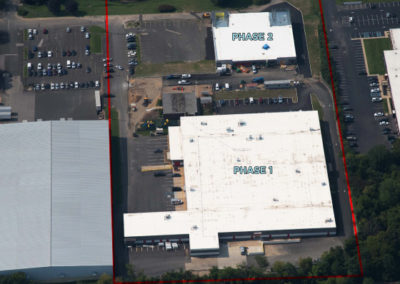

CubeSmart

District Heights, MD

Acquired in June 2018, the District Heights development site is strategically located on 3.2 acres inside the Metropolitan Washington, DC Beltway. The site includes a newly constructed 110,000 square foot, 900-unit, 3-story climate-controlled storage facility and an outparcel pad with Marlboro Pike frontage.

In June 2021, the joint venture completed the successful sale of the facility to Extra Space Storage, a globally recognized leading self-storage REIT.

Extra Space Storage

Charlotte, NC

A newly constructed Class A multi-story climate-controlled self-storage facility at the intersection of Johnston Road and Highway 51 in Charlotte, North Carolina. This state-of-the-art facility consists of more than 117,000 square feet of storage and ground floor retail space across five stories.

In December 2021, 38 months after initially closing on the land, the joint venture sold the trophy-quality asset to an unnamed global asset manager.

The Quarter

Charlotte, NC

The Quarter South End in Charlotte is a collection of adaptive reuse projects totaling nearly 150,000 square feet and a surrounding mixed-use development. The adaptive reuse buildings offer tenants a range of available spaces from 5,000 square feet to 77,000 square feet.

704 at The Quarter

Charlotte, NC

704 at The Quarter, a ground up mixed-use development, will feature a 306-unit apartment community with 5,900 square feet of ground floor retail space.

Switch Yard

Charlotte, NC

Switch Yard is a 92,000 square foot Class AA creative office redevelopment project located on 3.8 acres fronting Tuckaseegee Road in the Freight District, one of Charlotte’s fastest growing commercial neighborhoods. The project includes a pair of legacy midcentury warehouse assets acquired in August 2020, totaling over 80,000 square feet, and the addition of a two-story glass annex to create a dramatic streetscape and differentiate the property within the market.

Switch Yard is the Freight District’s first structure-parked office asset. The development can accommodate tenants from 6,000 to 60,000 square feet and features an elevated outdoor tenant amenity space.

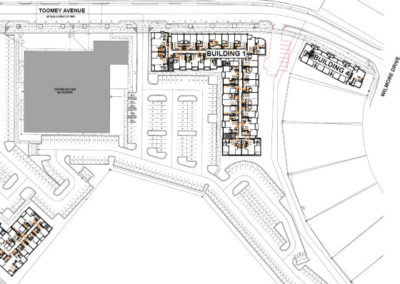

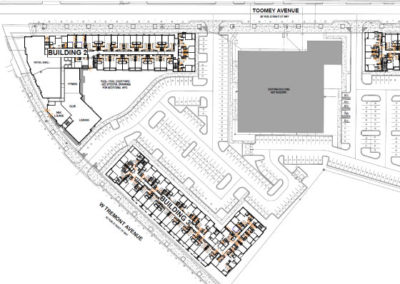

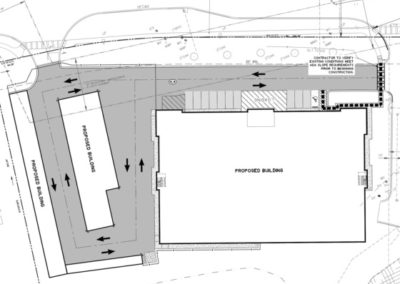

Extra Space Storage

Durham, NC

An opportunity zone investment, Extra Space Storage in Durham is a ground-up new construction property. The land was purchased in November 2020 and the facility became operational in May 2022. It is an investment between Big Cypress Capital and Abacus/Smith Point Capital. The building is managed by Extra Space.